cap and trade system vs carbon tax

A carbon tax imposes. The Canadian federal tax will price carbon at 20 a ton or 44 cents per liter of gasoline and rise to 50 in 2020.

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

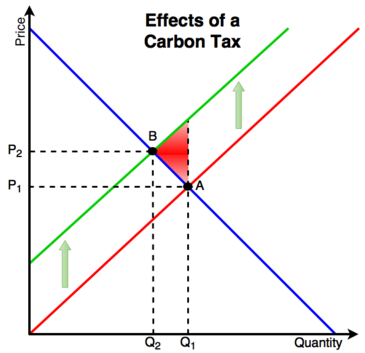

With a tax you get certainty about prices but uncertainty about emission reductions.

. They implemented a voluntary cap and trade program which is the first of two leading finance-based environmental solutions. A Critical Review Lawrence H. Goulder and Andrew Schein NBER Working Paper No.

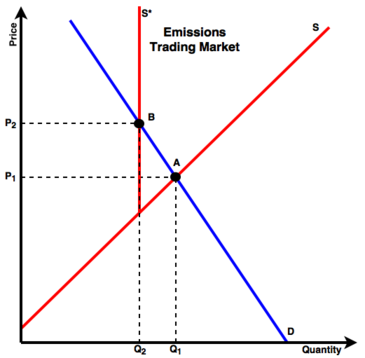

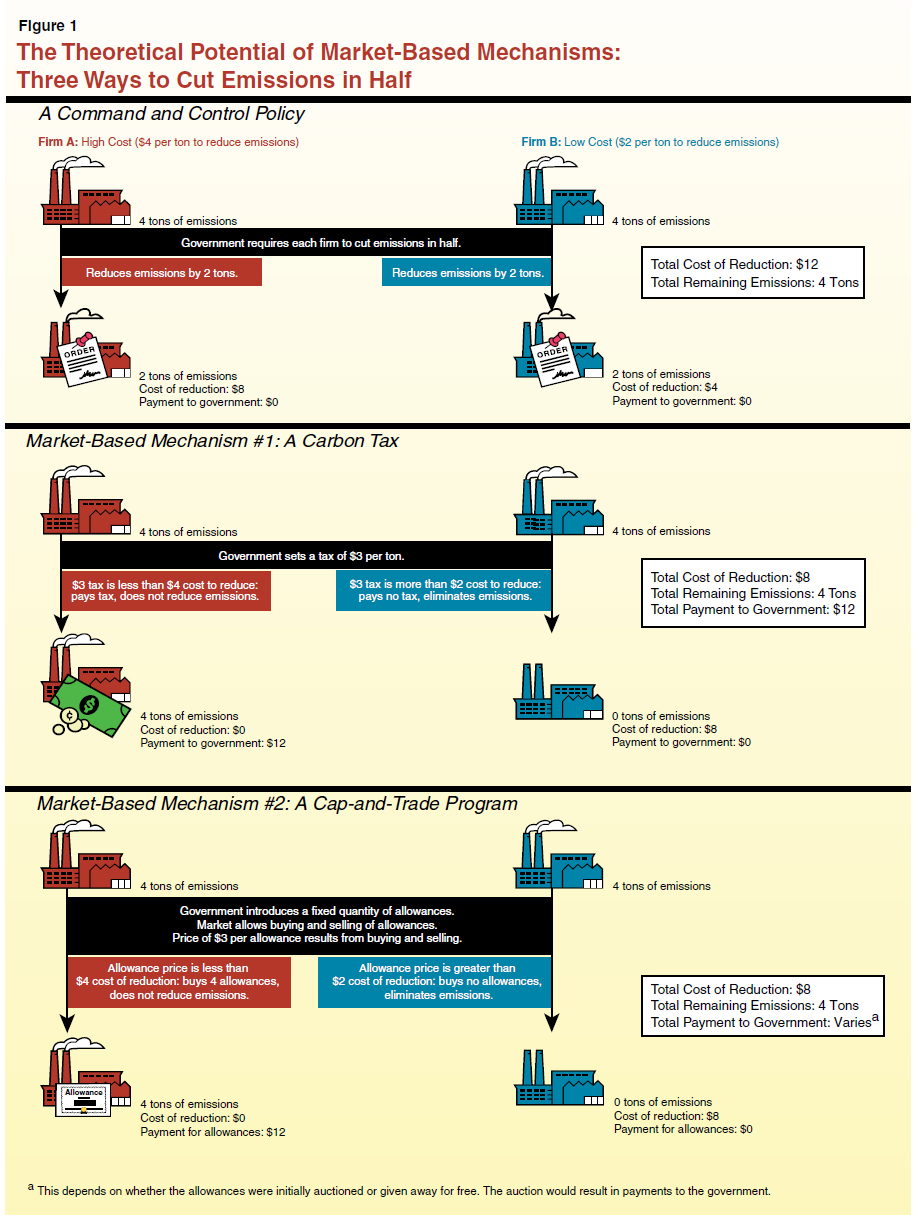

The cap and trade system is thus functionally similar to a tax on carbon. Indeed in stable world with perfect information cap and trade would be exactly equivalent to a carbon. H23Q50Q54 ABSTRACT We examine.

19338 August 2013 JEL No. Ad Learn about how and why companies should be using carbon credits. April 9 2007 413 pm ET.

They lean toward a cap-and-trade system which would set a limit on carbon-dioxide emissions and require companies to obtain permits to release carbon. While both carbon tax and cap-and-trade system aim at reducing greenhouse emissions they use a different approach and yield slightly different. A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system.

This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. Carbon taxes vs. Stavins Harvard Kennedy School abstract There is widespread agreement among economists and a diverse.

While a carbon tax sets the price of CO2 emissions and allows the market to determine the amount of reduced emissions a cap-and-trade system sets the quantity of. Three years ago 56 percent of Canadians supported a. The EU implemented its cap-and-trade system in 2005 to reduce their carbon emissions from 10000 industrial emitters in the Union David Suzuki Foundation 2020.

With a cap you get the inverse. We examine the relative. Revenue vs environment.

Theory and practice Robert N. If the European Unions Emission Trading Scheme. The basic idea of a cap-and-trade system is to control carbon emissions by creating a regulated marketplace in which polluters can buy and sell emissions while adhering.

Goulder Andrew Schein. Issue Date August 2013. Carbon Tax vs.

This guide helps you evaluate the role of carbon credits in corporate climate strategies. The second is a Carbon Tax and in this article. You can tweak a tax to shift the balance.

It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas.

Green Supply Chain News Summarizing Cap And Trade Versus Carbon Taxes To Deal With Co2

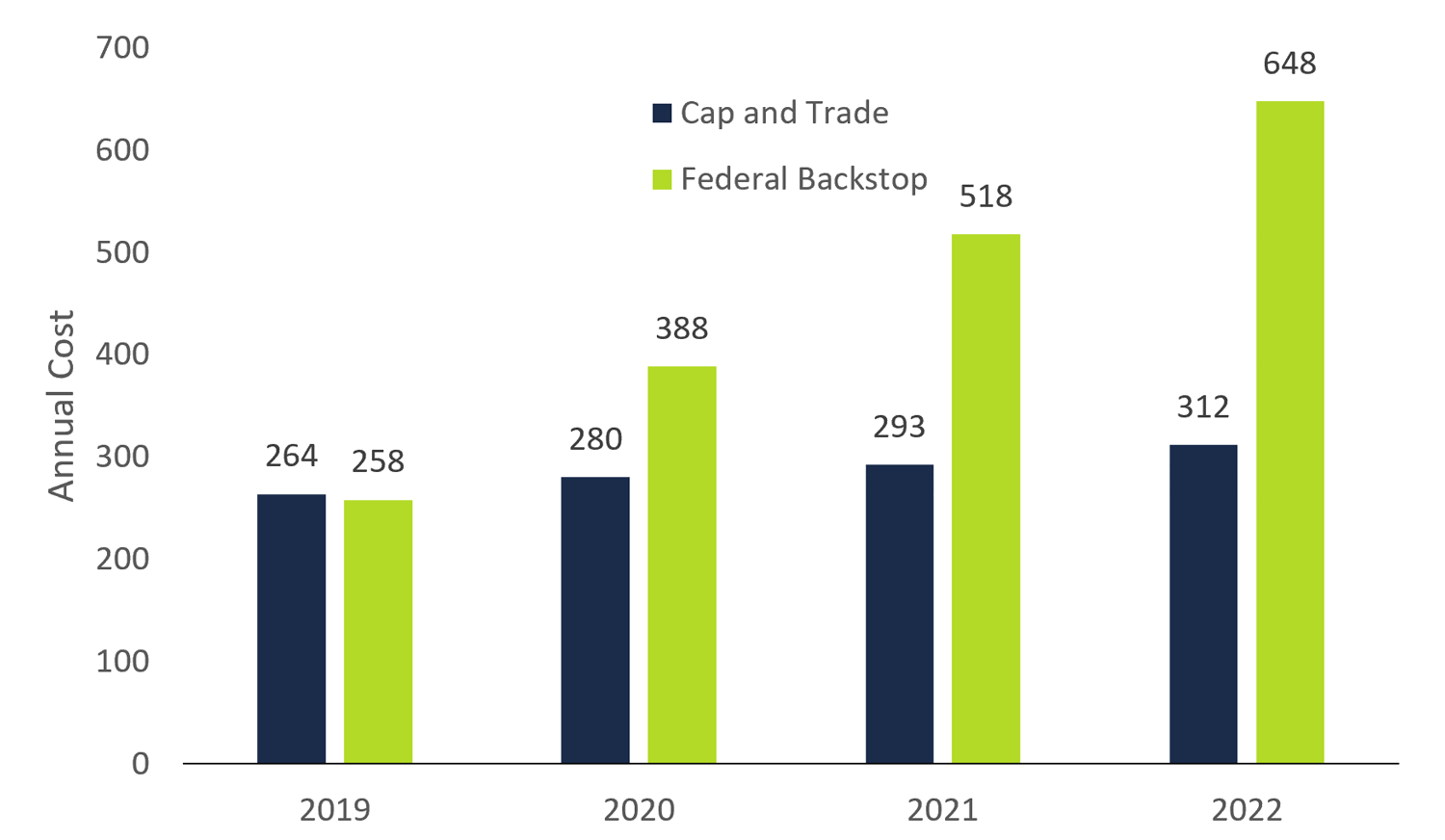

Estimated Impacts Of The Federal Carbon Pollution Pricing System Canada Ca

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Carbon Tax Vs Emissions Trading Energy Education

Estimated Impacts Of The Federal Carbon Pollution Pricing System Canada Ca

Economist S View Carbon Taxes Vs Cap And Trade

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Economics Help

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Difference Between Carbon Tax And Cap And Trade Difference Between

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Carbon Tax Vs Emissions Trading Energy Education

Comparison Of Carbon Tax And Cap Trade Eme 803 Applied Energy Policy

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Cap And Trade Vs Taxes Center For Climate And Energy Solutionscenter For Climate And Energy Solutions